In our portfolio construction, we use a Global Macro All Weather approach designed to deliver alpha returns in all market conditions, whether bull or bear.

Our methodology focuses on the accurate identification and assessment of market regimes, combined with the use of advanced hedging techniques to safeguard our investment and trading portfolios.

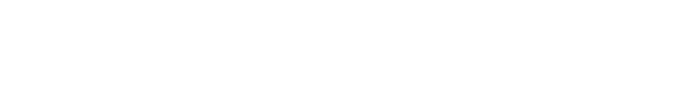

Our trading portfolios leverage advanced strategies, such as volatility arbitrage, dispersion strategies, convexity hedging, and premium harvesting, among others.

We are a team of derivatives traders and tech professionals from various countries, including Spain, Italy, and Denmark, dedicated to researching advanced portfolio construction, hedging techniques, and derivatives trading.

Our work places a special emphasis on volatility arbitrage and a quantitative approach to portfolio management, whether for investment or trading portfolios.

Our goal is to develop complex portfolios designed to deliver consistent, uncorrelated returns over the long term.

We employ adaptive and dynamic hedging techniques to optimize our trading and investment portfolios. By leveraging advanced derivatives structures, we aim to achieve versatility and cost-effectiveness in these activities.

Mantente informado de todo lo que pasa en el mundo del trading en nuestro blog